Recently, Bitcoin’s price plummeted below $80,000, marking its lowest point since November 2024. This triggered widespread panic selling, leading to a sharp market downturn. However, within just a week, market sentiment rebounded, pushing Bitcoin back up to around $96,000 before experiencing another pullback. The unpredictable nature of crypto markets, with Bitcoin, Ethereum, and other digital assets undergoing extreme volatility, leaves investors both excited by opportunities and anxious about risks.

In such an uncertain environment, finding a way to achieve consistent profits has become a key focus for traders. BYDFi, a globally recognized crypto exchange, understands these challenges and offers intelligent strategy trading tools designed for automated decision-making and risk management. With an intuitive interface and powerful automation, BYDFi’s tools have become essential for traders looking to seize market opportunities.

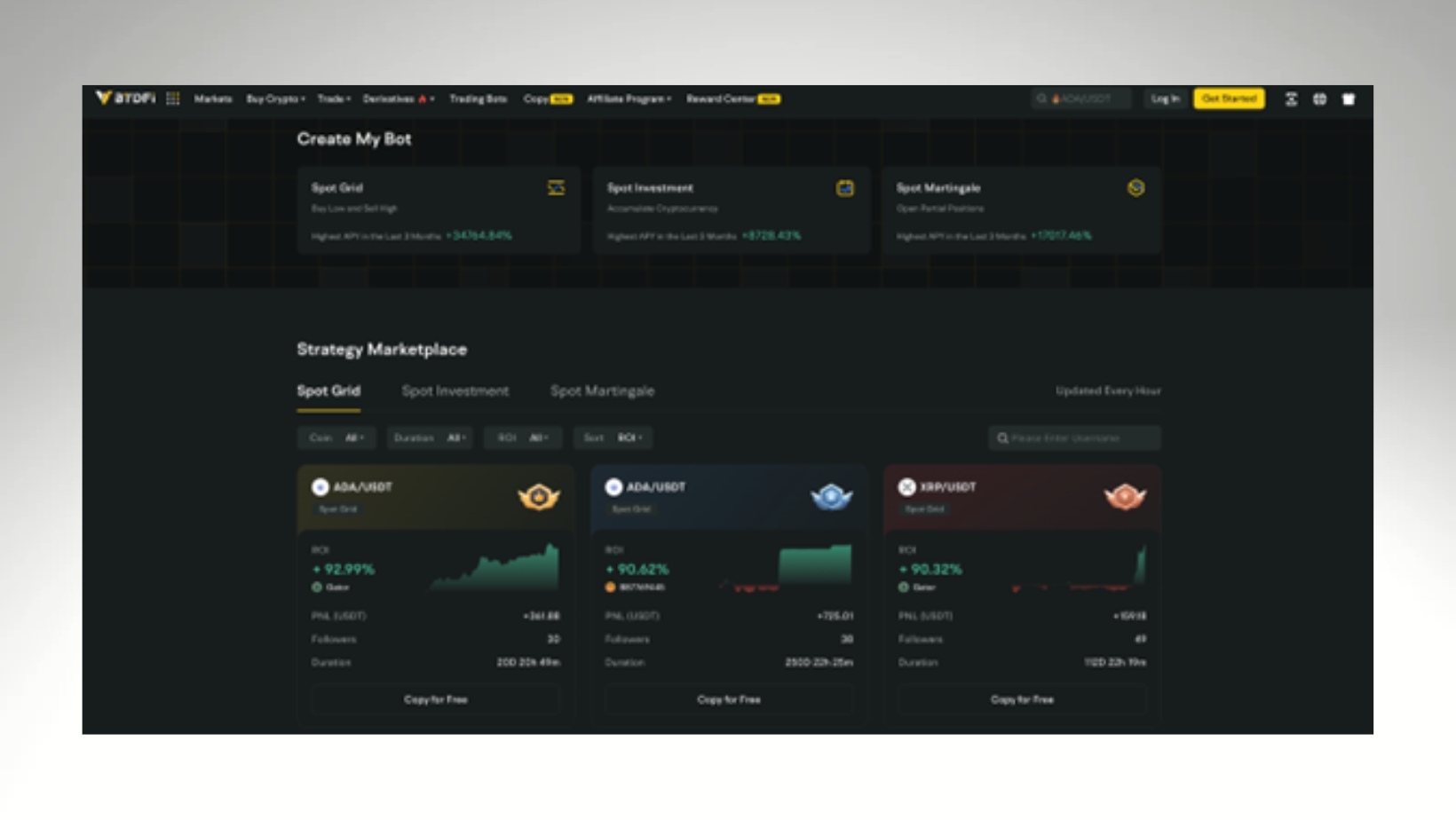

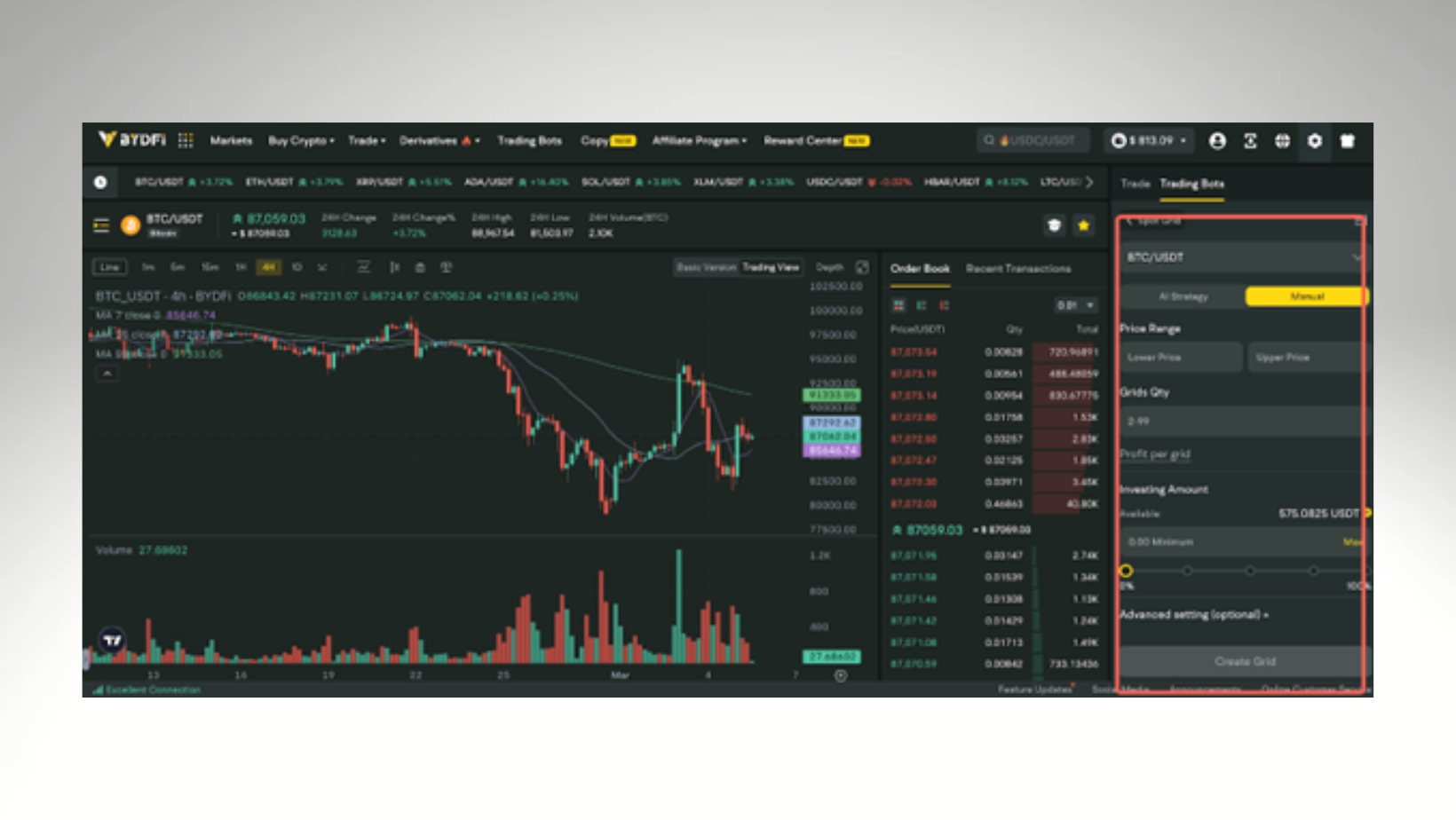

Grid Trading: A Profit Machine in Volatile Markets

Grid trading offers a smart and systematic way to profit from volatile markets with minimal effort. Once a user defines a price grid, the system automatically executes batch purchases at lower prices and batch sales at higher prices, ensuring multiple profit cycles in fluctuating market conditions.

By continuously leveraging this buy-low, sell-high mechanism, traders can optimize their gains without constant monitoring, making it an ideal choice for short-term investors seeking automation.

Why Choose Grid Trading?

- Ideal for Volatile and Bullish Markets: Tight grids increase trade frequency, while wider grids optimize returns.

- Rules-based approach: Eliminates emotional trading decisions.

- Beginner-friendly: Runs automatically, with no need for constant monitoring.

BYDFi Grid Trading Settings:

- Price Range: The maximum price should not exceed 5 times the latest market price, while the minimum price should not be lower than 1/5 of the latest market price.

- Grids Qty: Set between 2 and 99 grids.

- Trigger Price: When the token reaches the set price, the grid strategy activates.

- Take Profit & Stop Loss: Customize settings based on account balance and risk tolerance.

For users unfamiliar with parameter settings, BYDFi offers an AI Strategy feature, allowing traders to replicate high-ROI strategies recommended by the platform.

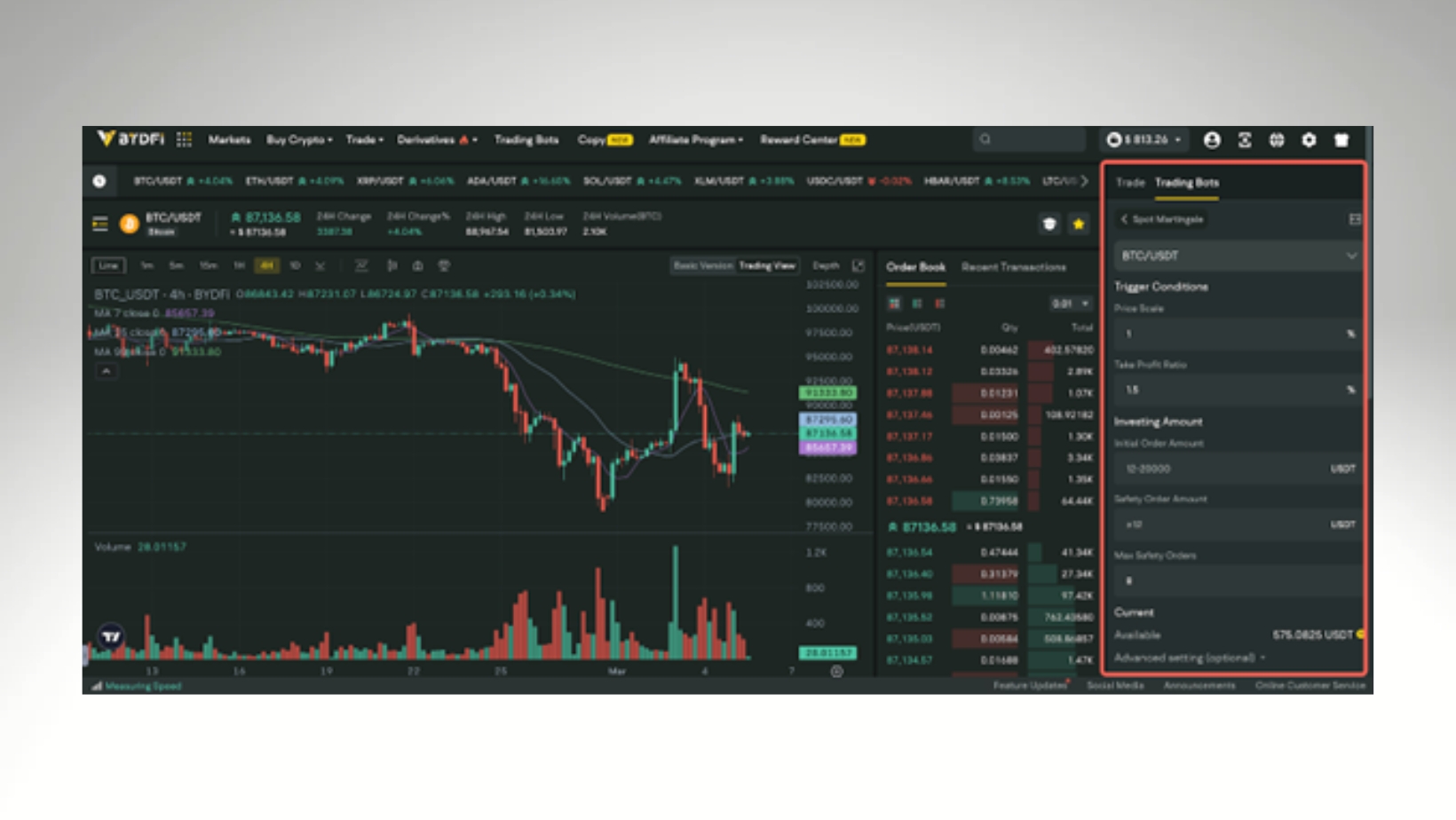

Martingale Strategy: A Contrarian Approach for Bearish Markets

The Martingale strategy focuses on increasing investment amounts during market declines, averaging down costs through incremental buying, and profiting when the market rebounds.

While this strategy requires careful fund management, it remains appealing to high-risk, high-reward investors.

Why Choose the Martingale Strategy?

- Effective in volatile markets: Gradual accumulation reduces average costs.

- Best for Well-Funded Investors: Profits increase as the market rebounds.

- Simple and automated execution: Easy to implement for steady profitability.

Key Martingale Parameters:

- Initial Order Amount Define starting trade size.

- Trigger Price: The price level at which the strategy activates.

- Safety Order Amount and Max Safety Orders: Set the rate and number of additional entries to minimize overall cost.

- Take Profit & Stop Loss: Predefine maximum gain and loss thresholds.

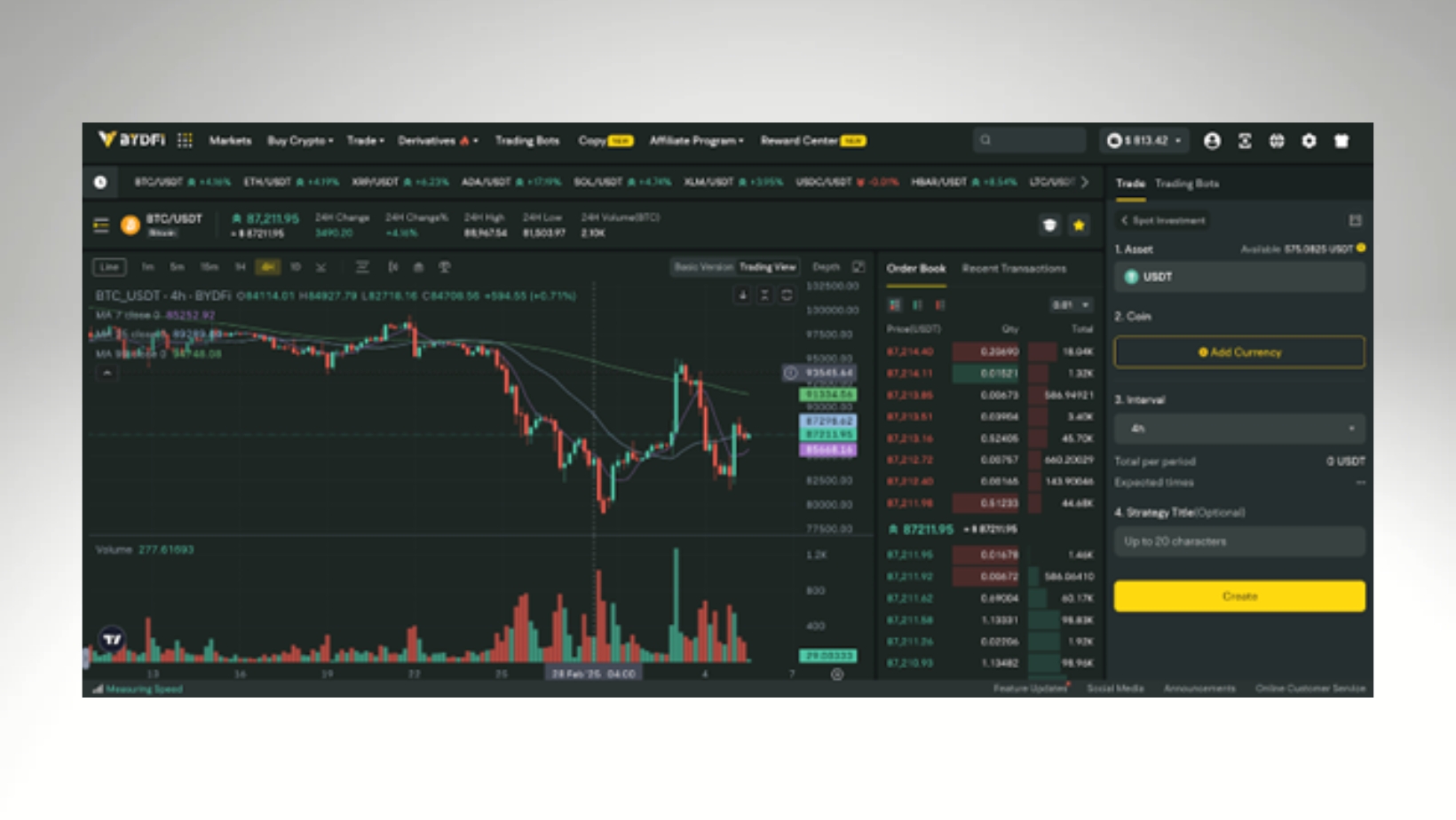

Spot Investment: The Finest Weapon for Long-Term Holders

For investors who believe in the long-term value of BTC, XRP, SOL, and other crypto assets, short-term market swings become less relevant.

The Dollar-Cost Averaging (DCA) strategy allows investors to systematically allocate funds at regular intervals, reducing the risk associated with lump-sum investments while benefiting from the power of compounding over time. According to BYDFi data, the highest annualized return from a DCA strategy in the past three months was 17017.46%.

Why Choose Spot Investment?

- Perfect for Long-Term Investors: Reduces stress caused by short-term volatility.

- Risk diversification: Avoids the pitfalls of investing large amounts at a single price point.

- Flexible customization: Adjust investment amounts and intervals or pause/stop at any time.

BYDFi Spot Investment Settings:

- Funding Source: Choose from available fiat or crypto balances.

- Target Assets: Supports up to 10 cryptocurrencies for simultaneous DCA.

- Interval: Options range from hourly to monthly schedules.

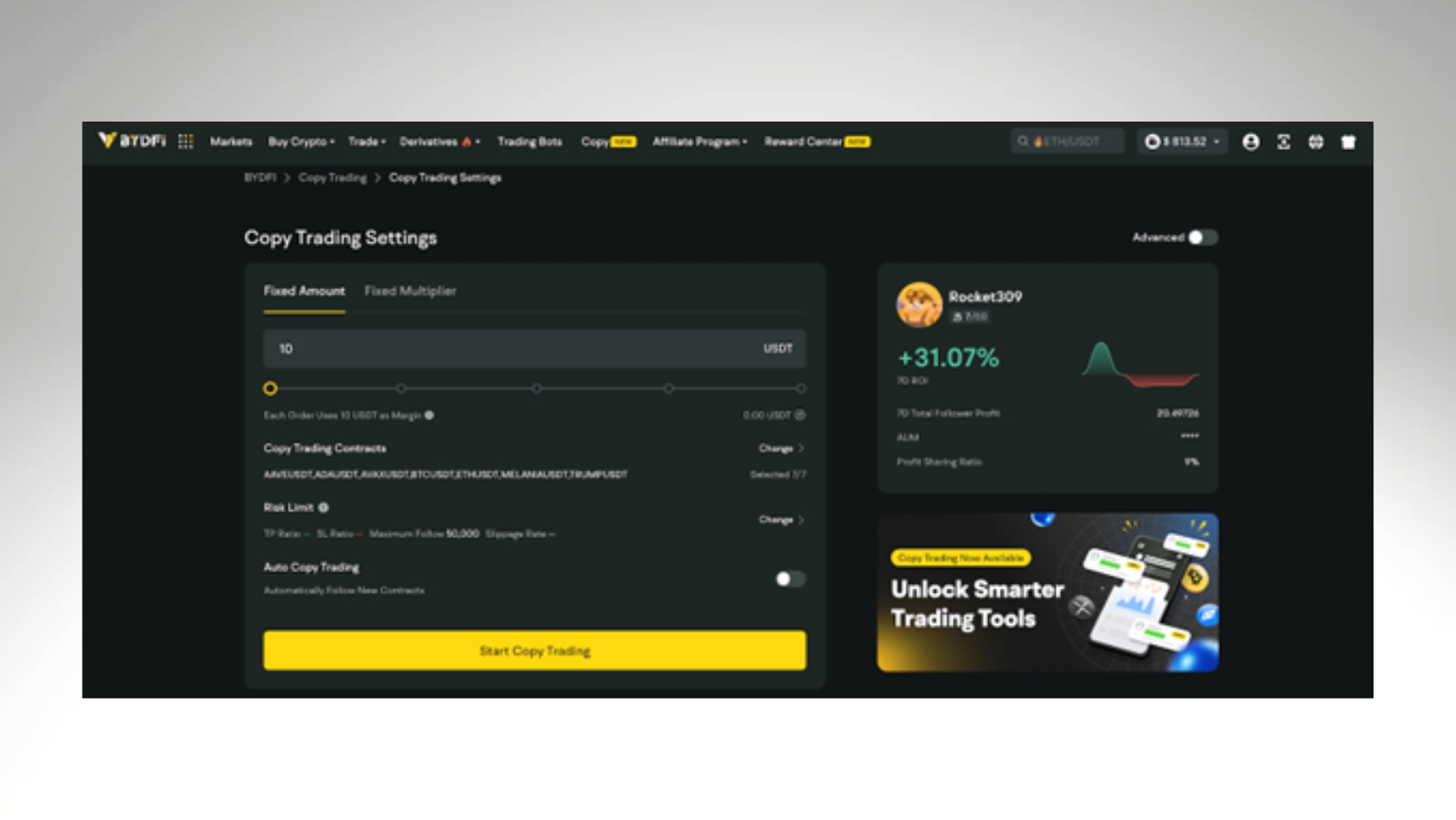

Copy Trading: Leverage Expert Strategies with Ease

For novice traders unfamiliar with market trends, copy trading is an efficient and convenient solution.

BYDFi brings together top-performing traders, allowing users to select strategies that align with their goals and automatically replicate expert trades.

Why Choose Copy Trading?

- Simplifies trading: No need for extensive market research—just follow proven strategies.

- Access to professional expertise: Increase profitability by mirroring successful traders.

- Leverage amplification: Utilize margin to maximize gains with minimal capital.

- Hands-free execution: Trades are automatically placed without manual intervention.

BYDFi Copy Trading Settings:

- Trader Selection: Choose based on ROI, trading style, and preferred cryptocurrencies.

- Fixed Multiplier vs. Fixed Investment: Adjust based on personal risk tolerance.

- Take Profit & Stop Loss: Customize maximum profit targets and acceptable loss limits.

- Supported Assets: Trade hundreds of token contracts, including BTC, ETH, XRP, DOGE, SOL, and meme coins like PEPE and Trump Coin.

BYDFi supports up to 200x leverage, with flexible margin options (cross/isolated) to reduce liquidation risks and optimize capital efficiency. With a minimum investment of just $10, copy trading is accessible to traders of all levels.

BYDFi: Seize Every Market Opportunity

BYDFi’s high liquidity and low fees make it an essential platform for traders worldwide. According to BYDFi co-founder Michael:

“As a globally recognized crypto exchange, BYDFi offers comprehensive spot and derivative trading services. Our strategy trading features cater to various risk appetites and investment goals. Moving forward, we will continue innovating and launching more advanced and differentiated investment strategies and tools. BYDFi remains committed to delivering a world-class crypto trading experience for every user.”

Currently, BYDFi offers exclusive rewards of up to 8,100 USDT for new users. Additionally, the platform’s 5th-anniversary celebration is set to launch, with exciting rewards and surprises on the horizon. Visit the BYDFi website or download the app to stay updated on the latest promotions.

About BYDFi

Founded in 2020, BYDFi is recognized by Forbes as one of the Top 10 Global Crypto Exchanges, trusted by over 1,000,000 users worldwide. The platform holds multiple MSB (Money Services Business) licenses across various jurisdictions and is a member of South Korea’s CODE VASP Alliance, reinforcing its commitment to compliance and security. All user funds are backed by a 1:1 reserve ratio, with regular Proof of Reserves (PoR) audits to ensure transparency and asset protection.

BYDFi provides 24/7 multilingual customer support, ensuring assistance is always available whenever needed.

- Website: https://www.bydfi.com

- Support Email: [email protected]

- Business Partnerships: [email protected]

- Media Inquiries: [email protected]